Though these disclosures are meant to provide an overview of an insurer’s climate-management practices and are not judged by length, the limited content analysis in some findings highlights the need for more substance on the part of insurers.

The insurance industry has been assessing and underwriting weather-related risks

since the early days of its inception, and climate change has added a layer of

complexity to this analysis. In addition to physical risks impacting claims,

climate change can also affect the value of investments as the economy

transitions away from fossil

fuels

and implements climate-change mitigation. The Deloitte Center for Sustainable

Progress

estimates

the costs of climate change could reach $178 trillion by 2070 and that

decarbonization could net $43 trillion over 50 years.

Actuaries are key in helping insurance companies recognize these risks and

identify approaches to moderate their impact. Disclosures are one of the tools

actuaries use for assessment — with the framework developed by the Task Force

for Climate-related Financial Disclosures (TCFD)

as the most commonly used, internationally.

For reporting year 2021, the National Association of Insurance Commissioners

(NAIC)

announced

a new standard for climate-risk disclosures that aligns with TCFD benchmarks —

allowing insurers to fulfill disclosure requirements by either submitting an

NAIC Climate Risk Disclosure or a TCFD report.

A review of reporting

According to the Society of Actuaries (SOA) Research Institute

report, Analysis of US Insurance Industry Climate Risk Financial

Disclosures,

there were 446 unique filings for reporting year 2021 — the first year that

insurers could use the NAIC’s TCFD-aligned survey structure. The number of

unique filings per business line is listed below:

The filings illustrate the variety of approaches. Some consist of a broad

discussion of how climate change affects various aspects of the insurer’s

business. Others focus on a single area — such as underwriting-related risks —

while neglecting other relevant areas, such as investment-related risks.

Furthermore, some insurers have sophisticated governance and management

processes for addressing climate risks — while others have less robust

approaches. Though some insurers assert that climate change does not affect

their business model, the strength of their supporting arguments varies

considerably.

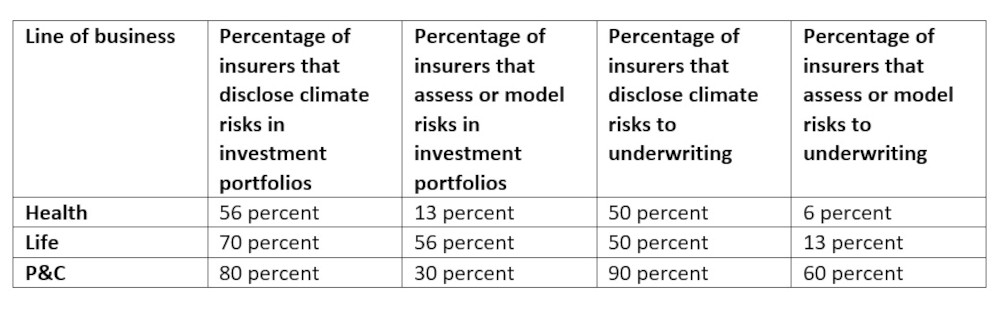

The chart below highlights some high-level observations from an analysis of a

stratified random sample of 16 filings each from health, life and P&C lines of

business:

Analysis of the answers to the NAIC’s list of voluntary yes/no questions, which

reveal the presence or absence of TCFD disclosure features, finds that 55

percent of life insurers and P&C insurers have publicly disclosed at least one

climate-related goal. However, only 36 percent of health insurers disclose at

least one climate goal. Furthermore, 91 percent of disclosures in the analyzed

sample reported having a Board member(s) or committee tasked with overseeing the

management of climate-related financial risks.

Analyzing climate risks in investment portfolios

The SOA Research Institute also

surveyed

insurers and asset managers in the US to analyze the assessment tools and

metrics they use to measure climate risk in their investment portfolios and how

they disclose the results. The survey found that most US insurance companies do

not have a formalized method to manage climate risk in their portfolios. On the

other hand, nearly all are committed to aligning their portfolios with carbon

footprint reduction.

Surveyed companies that do track climate risk all reported disclosing their

findings with internal stakeholders, such as Boards and risk and investment

committees. Many also disclose findings publicly through their annual reports.

About half of those surveyed reported using the TCFD framework.

Those that do not yet disclose climate-risk metrics are in the beginning stages

of measuring them and expressed the intention to make their metrics public once

their models are mature.

Companies surveyed agreed there was a need for standardized risk disclosures for

investment portfolios in the US and globally. Several have reached out to the

US Security and Exchange Commission advocating for this — stating that the

lack of high-quality climate-related information hinders the efficient

allocation of capital that can generate strong, long-term financial returns.

The actuarial role in the evolution of an organization’s climate-related

disclosures

The SOA report, TCFD: What Actuaries Need to Know,

outlines touchpoints on how actuaries can apply their training and experience to

the development of climate-related assessments. Some of these activities

include:

-

Identification, assessment and management of climate risks. Actuaries

across practice areas have experience working with a range of risks, which

can be impacted by climate change.

-

Scenario

analysis.

Actuaries can facilitate understanding of their organization’s underwriting

and investment

risks

and explain their potential impact.

-

Preparation of parts of climate-related reporting. Actuaries can explain

key elements of the reporting to their organizations and help make sure

final reports are accurate, meaningful and valuable.

-

Identification of organizational climate impacts at the enterprise

level. Actuaries can communicate the big picture of the risks associated

with extreme climate events.

Considerations for the future

The analysis of 2021 NAIC climate-risk disclosures reveals wide variation due to

each company’s unique exposure to climate risk.

Though these disclosures are meant to provide state regulators with an overview

of an insurer’s climate-management practices and are not judged by the length of

their filings, the limited content analysis in some findings highlights the need

for more substance on the part of insurers. For example, nearly 40 percent of

disclosures are less than two single-spaced pages.

Additionally, many of the disclosures focus on one side of the balance sheet and

neglect the other. P&C insurers often focus on underwriting risks while life

insurers zero in on investments. The most comprehensive disclosures, however,

focus on both.

Reviewing examples and publicly available disclosures of other insurers could

help companies assess their practices.

Visit the SOA Research Institute’s Catastrophe and Climate

webpage for the latest

resources on assessing and managing climate risk’s impact.

Published Dec 14, 2023 11am EST / 8am PST / 4pm GMT / 5pm CET

R. Dale Hall, FSA, MAAA, CERA is managing director of the Society of Actuaries Research Institute.